MyWorks supports handling Shopify Store Credit in several different scenarios:

- When a Shopify order is refunded to Store Credit

- When Store Credit is used to partially or fully pay for a Shopify Order

Setting up Store Credit in MyWorks

All that's necessary for MyWorks to handle syncing Store Credit in refunds and orders is to correctly set a QuickBooks account and item in the Store Credit section in MyWorks Sync > Settings > Payment Method.

- QuickBooks Account: This will be used for refunds to store credit that we sync to QuickBooks as Refund Receipts, as well as the payment account for orders fully paid by Store Credit. Since QuickBooks doesn't allow payments to be recorded to a liability account in QuickBooks, this account needs to be an asset or bank account, which would act as a contra-liability account.

- QuickBooks Item: This would be an item in your QuickBooks that can be linked to the above Store Credit account. This is used (as a negative line item) in orders that are partially paid by Store Credit.

%20%C2%B7%20MyWorks%20Sync%20Staging%20%C2%B7%20Shopify%202026-01-07%20at%203.47.39%20PM.png)

Refunds to Store Credit

When a refund occurs in a Shopify order that's issued to Store Credit, instead of the original payment method, MyWorks will sync it to QuickBooks as a Refund Receipt - and that refund will be recorded to the Store Credit account selected above.

%20%C2%B7%20Orders%20%C2%B7%202024-1224%20%C2%B7%20Refund%20%C2%B7%20Shopify%202025-11-24%20at%203.31.41%20PM.png)

Store Credit used to pay an order

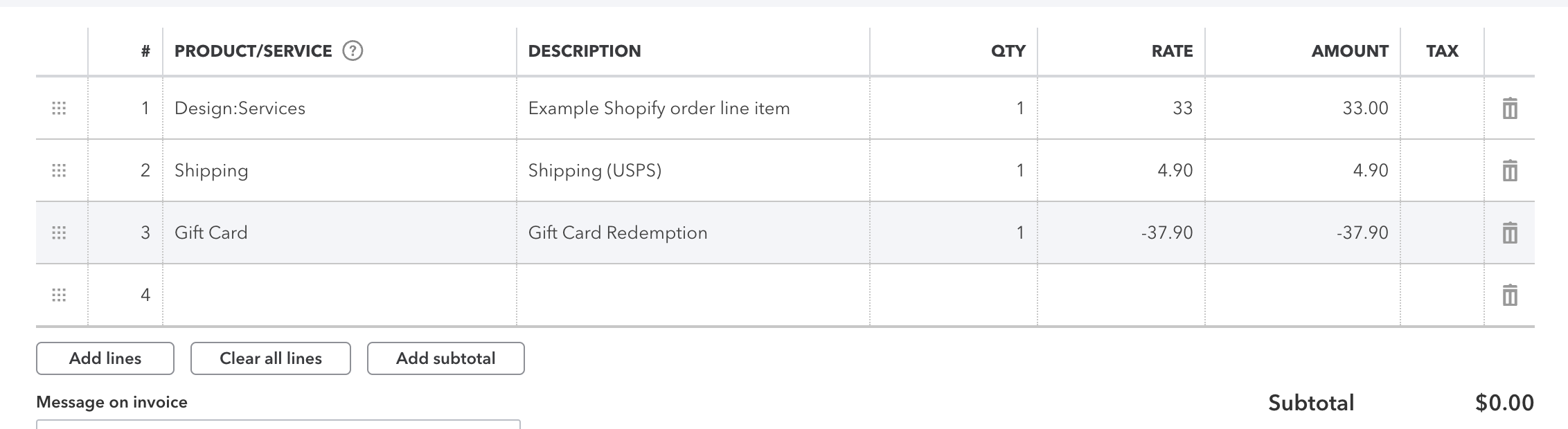

When Store Credit is used in Shopify to partially or fully pay for an order, MyWorks Sync will include that redemption in the QuickBooks order synced.

- If partially paid with store credit, as a negative line item, using the Store Credit product in QuickBooks.

- If fully paid with store credit, recorded to the Store Credit bank account in QuickBooks.