MyWorks makes it as easy as possible to handle accounting for the sales tax collected in Shopify. We'll automatically sync the tax charged on the order into QuickBooks Online as we sync the order: no setup needed on your part!

In the US, Automatic Sales Tax is normally enabled in QuickBooks Online, which would look like the below example in your QuickBooks Sales Tax Overview:

MyWorks is also compatible with the automated Shopify Tax service in Shopify, or manual rates, if you choose to create them in Shopify. When enabled in Shopify, MyWorks will sync the accurate sales tax collected on the order into QuickBooks.

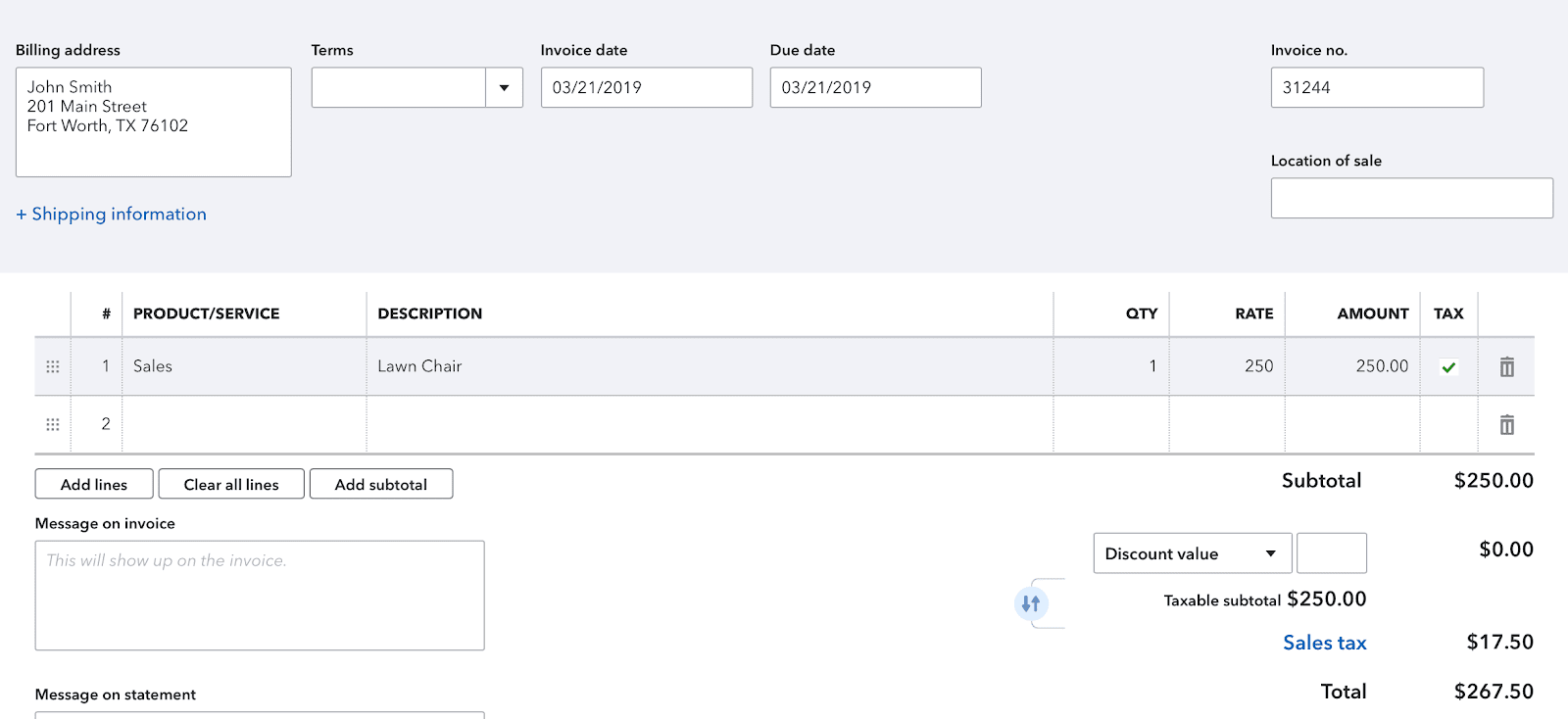

When using Automated Sales Tax in QuickBooks Online (US)

If your QuickBooks Online company is in the United States, you likely have Automated Sales Tax enabled. The Sales Tax collected in the Shopify order will be passed into the "Sales Tax" subtotal field in QuickBooks Online. This will always match what's collected in the Shopify order, and you can use reporting in Shopify and/or QuickBooks Online to report on the detail/regions for sales tax collected. There's nothing to configure in MyWorks to accomplish this - tax will sync automatically!

Syncing tax as a line item

Alternatively, if you do not wish to use the QuickBooks Online Automated Sales Tax feature, and/or have sales tax turned off in QuickBooks, you can sync tax as a line item in the QuickBooks order instead.

You can enable the setting to sync sales tax as a line item in MyWorks Sync > Settings > Tax, and the line item used in QuickBooks can be controlled in several different ways:

- You can select a single QuickBooks product to be used for the sales tax line in QuickBooks. This is the item that will be used by default, unless a QuickBooks product is selected for the country/region in the section below.

- In the section below, you can select a specific/different QuickBooks item to use for the sales tax based on the country or region of the order. This can be helpful to track sales tax collected in separate accounts in QuickBooks based on the country, US state, or Canadian Province that the sales tax was collected for.

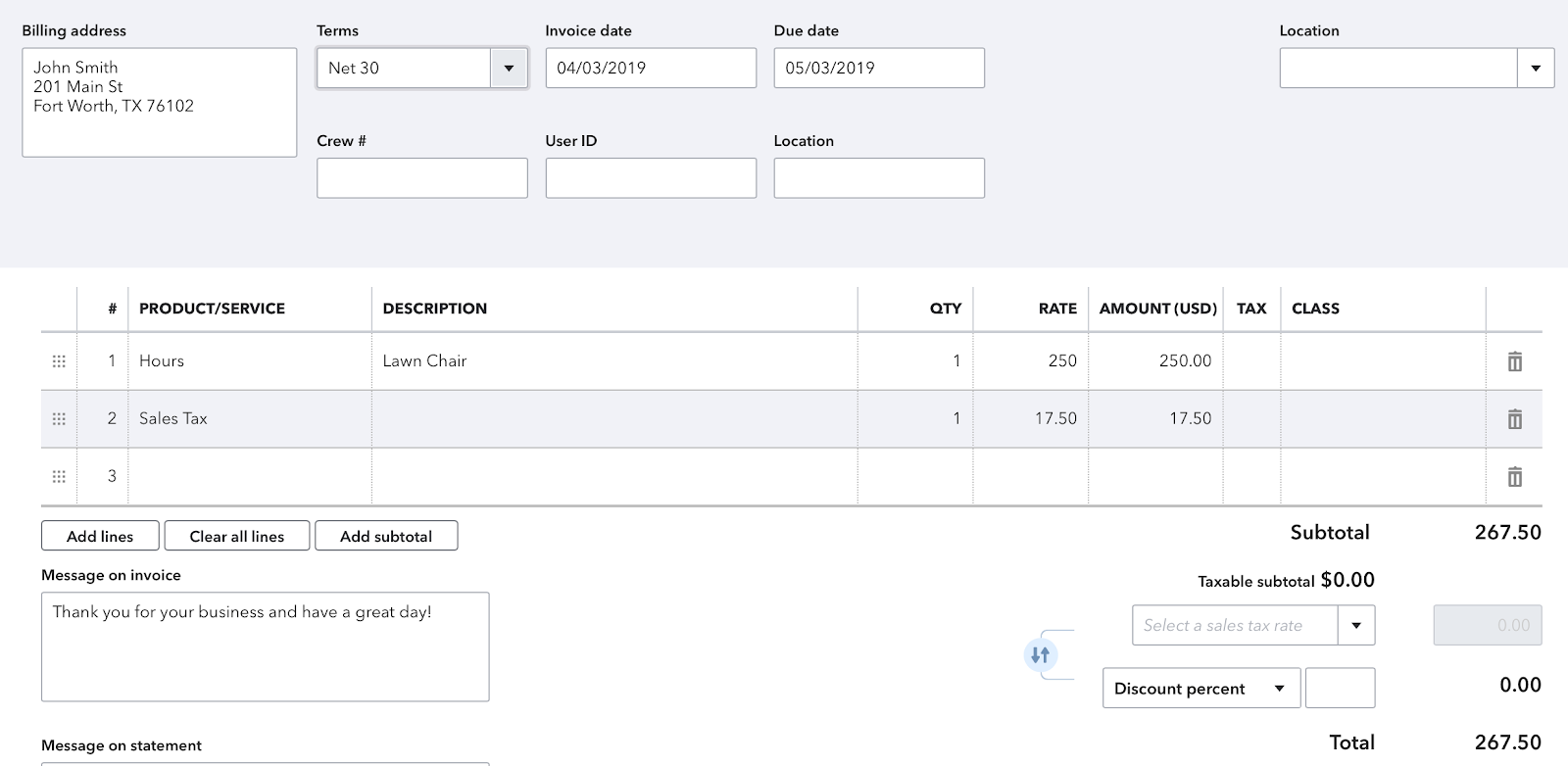

Once enabled, the Sales Tax collected in the Shopify order will be synced as a line item in the order in QuickBooks Online, as shown in the below example: